The First Home Loan Deposit Scheme (FHLDS) is an Australian Government initiative to support eligible first home buyers to build or purchase a new home sooner. The Scheme is administered by the National Housing Finance and Investment Corporation (NHFIC).

Usually first home buyers with less than a 20 per cent deposit need to pay lenders mortgage insurance. Under the Scheme, eligible first home buyers can purchase or build a new home with a deposit of as little as 5 per cent (lenders criteria apply). This is because NHFIC guarantees to a participating lender up to 15 percent of the value of the property purchased that is financed by an eligible first home buyer’s home loan.

In the 2020-21 Federal Budget, the Australian Government announced an additional 10,000 FHLDS places for the 2020-21 financial year, specifically for eligible first home buyers building or purchasing new homes. These additional places are known as the First Home Loan Deposit Scheme (New Homes) or FHLDS (New Homes).

There are currently 27 participating lenders across Australia offering places under the First Home Loan Deposit Scheme.

Buying an Existing Homes

Eligible first home buyers can use the First Home Loan Deposit Scheme (FHLDS or the Scheme) in conjunction with other government programs like the First Home Super Saver Scheme, HomeBuilder grant or state and territory First Home Owner Grants and stamp duty concessions.

The guarantee is not a cash payment or a deposit for your home loan.

Download a fact sheet to learn more.

Buying a new Home

Eligible first home buyers can use the FHLDS (New Homes) guarantee in conjunction with other government programs like the First Home Super Saver Scheme, HomeBuilder grant or state and territory First Home Owner Grants and stamp duty concessions.

The guarantee is not a cash payment or a deposit for your home loan.

Eligible FHLDS properties

For a property to be eligible for the Scheme it must:

- be a ‘residential property’ – this term has a particular meaning under the Scheme, and you should ask your lender if there is any doubt

- have a purchase price (and value) under the price cap for its location

- be purchased by an eligible first home buyer under the Scheme

- list you as the sole registered owner/s of the property at the settlement date for your home loan

- be a property which is (1) an established dwelling, or (2) a new-build dwelling that is purchased under a house and land package, a land and separate contract to build a home or an ‘off-the-plan’ arrangement that is financed under an Eligible Loan from a participating lender.

Borrower eligiblity

The First Home Loan Deposit Scheme is open to singles or couples.

Singles

If you are looking to purchase your first home as the only person named as a borrower in your home loan, then you would apply under the Scheme as a single.

Couples

If you are looking to purchase your first home with your spouse or de facto partner, where you are both named as borrowers in your home loan, then you would both apply under the Scheme as a couple.

These are the only two types of applications that are eligible under the Scheme.

Home loan arrangements made with family or friends, with more than two borrowers, or any instance where the other borrower is not your spouse or de facto partner, are ineligible for the First Home Loan Deposit Scheme.

Your eligibility checks

There are several criteria used to determine eligibility as a first home buyer under the Scheme. You should consider whether your personal circumstances satisfy all of the following checks, including:

You need to satisfy all these checks to qualify for the Scheme. If you don’t meet the requirements for one or more of these checks, or have questions about any of these matters, you should ask your lender and/or seek appropriate advice.

Income test

The Scheme includes an income test for:

- singles – your taxable income for the previous financial year must not be more than $125,000.

- couples – your combined taxable income for the previous financial year must not be more than $200,000.

The income test is assessed by your lender.

For Scheme reservations made up to 30 June 2020, the relevant Notice of Assessment (NOA) from the Australian Taxation Office is for the 2018-19 income year. However, if you hold that reservation for too long (e.g. more than 90 days), your relevant NOA may end up being the 2019-20 income year.

For Scheme reservations made from 1 July 2020 to 30 June 2021, the relevant NOA is the 2019-20 income year.

Prior ownership test

The Scheme is in place to assist genuine first home buyers.

The prior ownership test requires you to not have ever owned:

- a freehold interest in real property in Australia

- an interest in a lease of land in Australia with a term of 50 years (or more), or

- a company title interest in land in Australia.

These tests apply for property interests in all states and territories of Australia, regardless of whether the property was a commercial property, an investment or owner-occupied, and whether it was ever lived in.

They also apply if any of the interests listed above have been held by you on your own or together with someone else – for example, where you held an interest in property with a former spouse or de facto partner.

Note that if either of you – whether individually or with someone else – have held any of the interests listed above, as a couple you are not eligible first home buyers.

For your home loan to be covered by the Scheme, you will need to make a statutory declaration that confirms you have not held any interests of this kind. This declaration is made under the First Home Buyer Declaration provided to you by your participating lender.

If you are unsure of whether you have held any of the interests listed above you should ask a professional adviser, as you will need to be sure that you are not giving a false declaration.

Citizenship test

The Scheme is only open to current Australian citizens.

The citizenship test for you being an ‘eligible first home buyer’ for the Scheme is that you will need to be an Australian citizen at the time you enter into a home loan with your participating lender.

If you are applying under the Scheme as part of a couple, you will both need to be Australian citizens.

The Scheme is not open for permanent residents who are not Australian citizens.

Minimum age

The Scheme is only open to persons that are 18 years of age or over.

The minimum age test requires you to be 18 years of age or over at the time you enter into a home loan with your participating lender.

Deposit requirement

There is a minimum deposit requirement for the Scheme.

The Scheme is to assist singles and couples (together) who have at least five per cent (5%) of the value of an eligible property saved as a deposit. The 5% must be made up of genuine savings. If you have 20% or more saved, then your home loan will not be covered by the Scheme.

Your Participating Lender will be able to tell you if you satisfy this requirement. You should also confirm with your Participating Lender whether any cash grants under other Australian Government, State or Territory schemes or programs you may receive can be considered as part of

genuine savings by that Participating Lender.

Owner occupier requirement

The Scheme is provided to assist Australians to purchase their first home.

Investment properties are not supported by the Scheme.

To meet the owner-occupier requirement, you will need to:

- move into the property within six months from the date of settlement or, if later, the date an occupancy certificate is issued, and

- continue to live in that property for so long as your home loan has a guarantee under the Scheme.

If you don’t live in your property – including where you move out of the property at a later time – your home loan will cease to be guaranteed by the Scheme*. In these circumstances there may be terms and conditions of your home loan that require you to take certain actions – including that you may be need to pay fees and charges and/or take out insurance that would not have otherwise applied if your home loan were participating under the Scheme.

Your participating lender will be able to explain these terms and conditions to you.

* Members of the Australian Defence Force (ADF) are still required to be owner-occupiers under FHLDS however if they are unable to meet the owner-occupier requirement because of their duties, they can still be eligible if, at the time of entering into their loan agreement, they intend to live in the property.

Open homes across Brisbane are filling out each weekend as young people flock to the property market in the largest numbers since the GFC.

While the nation slugs through the deepest recession in a century Reserve Bank Governor Robert Lowe says now is the time to get on first rung of property ladder because “interest rates are low, they’re going to stay low”.

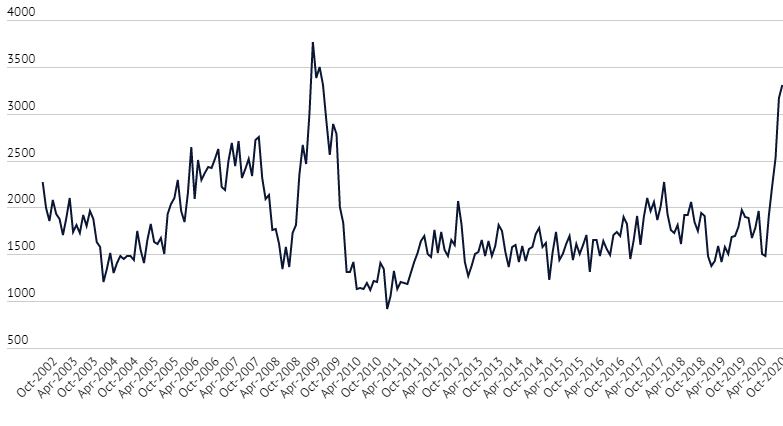

More Queenslanders took out their first mortgage in October than any other month since March 2009, when grants were temporarily tripled as part of the Rudd government’s defence against the global financial crisis.

How to apply

All applications for the First Home Loan Deposit Scheme need to be made directly with one of the Scheme’s participating lenders (or their authorised representatives, i.e. a mortgage broker).

NHFIC does not accept applications directly and we cannot provide personal financial advice.

First home buyers (and those advising a first home buyer) are encouraged to consult with a participating lender and seek their own independent financial and legal advice on how to structure their loan arrangements in a way that suits their own personal circumstances.

Participating Lenders

Following a competitive procurement process in 2019, NHFIC appointed 27 lenders to the panel of residential mortgage lenders able to offer guarantees under the Scheme.

Both National Australia Bank and Commonwealth Bank of Australia have offered Scheme-backed loans from 1 January 2020. The 25 non-major lenders have offered guaranteed loans from 1 February 2020.

All participating lenders are supporting the Scheme by not charging eligible customers higher interest rates than equivalent customers outside the Scheme.

Open homes across Brisbane are filling out each weekend as young people flock to the property market in the largest numbers since the GFC.

While the nation slugs through the deepest recession in a century Reserve Bank Governor Robert Lowe says now is the time to get on first rung of property ladder because “interest rates are low, they’re going to stay low”.

More Queenslanders took out their first mortgage in October than any other month since March 2009, when grants were temporarily tripled as part of the Rudd government’s defence against the global financial crisis.

Queenslanders entering the property market First-home buyer loan commitments

If you want more information ask one of the team at Hicks Real Estate, we can help you with a “New Beginning”

Article Source: qldpropertyinvestor.com.au

House prices are on the rise. Find out the value of your property now.

Get a free online property report from Hicks Real Estate. It takes seconds.