The cardinal rule of pricing is that the selling price of your home is determined by the buyers.

One of the greatest mistakes vendors can make is putting an inflated price – a hopeful price – on their property in the hope that someone might pay it.

If you put your home on the market for more than buyers perceive it’s worth, it can languish without offers, even in a booming market.

After four weeks, buyer interest tends to tail off quite dramatically so it’s crucial to get the pricing right during the first four weeks of the marketing campaign. If the sale is by auction or tender, it’s even more critical, because you have a limited period in which to establish qualified buyer interest.

What does not determine the price of your home

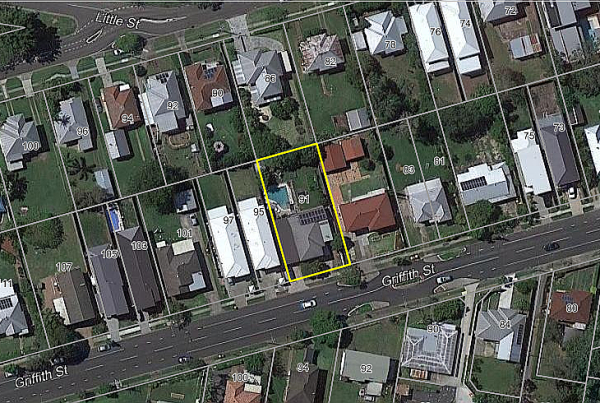

It is important for us (the Agent) to be as analytical in these prices as possible so when valuing your property we take into account comparable properties that have recently sold as this is direct evidence as to what buyers have been prepared to pay.

We also use comparable properties that are currently for sale as these properties will be your direct competition.

We need to ensure that your property has a fair chance of attracting buyer interest.

If you would like an appraisal of your home, give us a call on 07 3355 6845 or Click Here

All appraisals are free and absolutely no obligation to sell.

This depends on your circumstances. Four bedrooms are obviously better than three but not when it means reducing the size of other rooms or bedrooms. Our advice is to discuss your renovation ideas with someone who understands what buyers want beforehand.

You’re more than welcome to speak to us about your renovation plans.

There’s nothing in a sales contract stipulating how clean the home should be after the sale. We recommend sellers leave their homes as if they were planning to move into it themselves as a courtesy to the new owners.

Ask us about finding a reliable professional cleaner or for information on any other property sales-related topic.

Because most of the media companies that we use require their payment up front we require that the funds are paid when listing the property for sale.

Other arrangements may be arranged but this will be determined on a case by case basis.

It is important to know that as agents, we do not make a single cent from doing the marketing, in fact it actually creates more work for us to do however, we do it because it helps us to SELL YOUR HOUSE!

Families generally do need a bath tub for children and many people still enjoy a soak in the bath. We believe it is okay to remove your tub if you’re planning to be in the same home for a long time but it could be a mistake if you’re planning to sell and renovating purely to add value to the property.

Talk to us if you need more information about this or any other renovation-related question.

You’re not required to have a sign, but we do recommend it. We’ve found that signs become your silent salesman, letting everyone know that your property is on the market. Neighbours and people driving past will see the sign and either contact the agent directly or tell friends who might be interested in the property.

Contact us if you have questions about this or any other property sales-related issue.

Beauty is in the eye of the beholder they say. This is especially true of homeowners who might be blind to the faults in their homes. We recommend sellers get their properties inspected by someone with an objective eye to identify faults early on. This can avoid the possibility of discovering faults during buyer inspections, giving them cause to pull out of the sale or renegotiate the price. Our top tip is: a well-prepared property achieves a higher price.

If you need more information on this or any other sales-related issue, why not contact us now?

Contractually speaking…no you cannot break with an agent earlier than what is outlined in your agreement with them.

However, if you were our client we’d add a clause stating that we are happy to terminate at any time.

If you don’t have this clause in your current agreement and you are not happy, we advise you to approach your agent and tell them you want to cancel.

If they are obliging (which we hope most would) ask them to release you (IN WRITING) from your current agreement.

Having this in writing will give you proof that the agreement has been officially terminated.

If you are interviewing potential real estate agents to sell your home make sure you ask them for references from their past clients.

Here are tHicks Real Estatee essential questions you should ask an agent’s reference:

1. Did the agent work for you?

2. Did the agent communicate with you?

3. Did you trust them?

4. Would you want to work with this agent again?

For more information on interviewing for real estate agents. Download our free eBook – 11 Critical Questions to Ask When Interviewing a Real Estate Agent.

Ask yourself – ‘If I was buying a property today, what would I do, where would I look?’

Chances are, you would have answered with the internet, local paper, magazines, etc.

This is where we need to position your property so it receives full attention and reaches the maximum number of potential buyers.

You can’t sell a secret and no matter how fantastic your home is, if no one knows about it, it will take a while to sell.

Simple Selling Equation

Better ads = more enquiries = more inspections = more offers = better sale price $$$

Selling a home is a complex procedure. Whether it’s your first time, or you’re an experienced buyer, it’s very easy to forget things and to feel overwhelmed.

While you should always feel comfortable asking questions, the following “event road map” might help keep you on track.

Step 1: Prior To Listing

– Select an Agent

– Sign a listing agreement with your agent

Step 2: Listing Your Property

– Agent prepares marketing campaign and advertising materials

– Prepare your house for buyer inspections

– Agent conducts buyer inspections

– Agent negotiates a sale price to your satisfaction

Step 3: Accepting The Offer

– Offer is accepted

– Agent accepts a deposit from the buyer

– Contracts are exchanged

– Property “Under contract”

STEP 4: SETTLEMENT

– Settlement/SOLD

– Move out

An auction is a public sale by a licensed auctioneer where a property is sold to the highest bidder.

The vendor places a reserve price on the property and it will not be sold until bidding has exceeded this price.

If the bidding doesn’t reach the reserve, the property is passed in and the highest bidder has the first right to negotiate with the vendor.

For in demand property or for strong markets where there’s a reasonable expectation that you can generate more than one buyer to compete for a property at a similar level, auction comes into its own.

Compared to the theatre of a public auction, a sale by private treaty is a less dramatic more discreet selling process.

A private treaty sale allows you time to consider offers by potential buyers.

So it’s a less stressful process than an auction, where vendors are often called on to make snap decisions on auction day.

Because there’s no fixed time frame for the sale, your property may be for sale indefinitely.

This is a bonus if you can afford to wait until someone offers you the price you want, but a big drawback if you want a quick turnaround.

An Open listing is where any agent can sell your home and and no one’s responsibility.

Open agency is a fairly dated approach to selling real estate.

It came about in the days when there was good reason to believe that, in order to access all buyers, you needed to list your property with a number of agents to give yourself coverage.

Nowadays, with cost effective marketing tools such as the internet, and with more vendors prepared to invest a little bit of money up front for marketing the property, the need to share the listing with multiple agents is gone.

Yes. Buyers have two options when submitting an offer by tender.

Importantly the seller can close the tender at anytime.

Hence, if the seller receives an offer that they are happy to accept, they can bring the close date forward.

A common question we get asked is “Do I sell my property first then buy or buy first, then sell? The short answer is you can do both. However, we recommended selling first. Watch as Justin explains why.

Yes.

You can sell your home without an agent. Selling your home privately has the advantage of saving money on the commission fee, however it also means you need to organise photos, advertising, open homes, manage legal documents and also negotiate with potential buyers. Watch as Justin explains the pro’s and con’s of selling your home without an agent.

How to prepare you home for sale – the forgotten step which can cost sellers thousands! There is one step when preparing your home for sale that many of us don’t do and that’s because it hasn’t been necessary until just recently. Today’s buyers are very savvy and they want everything legal – including new structures. So before putting your home on the market, make sure you run some council searches to make sure you deck, extension or pool etc are certified. Watch as Madeleine explains.

Get a free online property report from Hicks Real Estate. It takes seconds.