With 2022 starting to wind down, it is time to look back on what has happened during the past year and what 2023 may have in store.

The year started with property markets very strong with prices rising every week. This also was reflected in the rental market with rents increasing quickly. A feature of the early months of the year was properties were only on the market for short periods of time. Buyers were snapping up properties within days of the property coming onto the market.

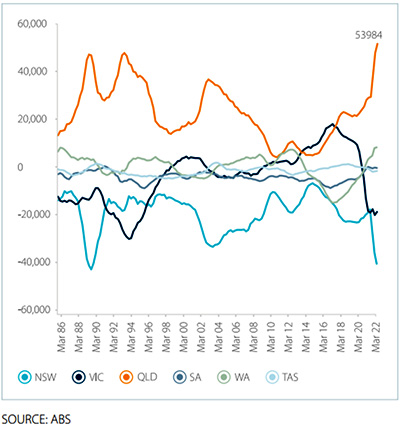

This huge amount of demand for Brisbane properties was partly driven by interstate migration. Encouraged by Brisbane’s relative real estate affordability compared to Sydney and Melbourne, and strong jobs growth, people from New South Wales and Victoria continue to pour across the border to resettle.

Around 92,000 people are calling Queensland their new home each year, a population growth rate of 1.8 per cent.

April/May saw the peak of the market as far as prices were concerned, which coincided with the start of interest rate rises.

The Reserve Bank of Australia, faced with inflation rising started a process of increasing the official cash rates. The aim was to slow down the rate of economic activity in an attempt to keep inflation in check.

The impact of the recent interest rate rises on housing is flowing through to lower volumes of new mortgage finance secured. From May through to October of this year, the monthly value of secured finance declined -17.9%. Annual sales volumes have trended -13.3% lower compared to this time last year. Consumer sentiment through November also dropped a notable -6.9%.

So the interest rate increases seem to be working.

The big question is what will happen with Interest Rates during 2023. The Reserve Bank has suggested that there may be more interest rate rises to come, but others are saying that there will be no more increases. So we will have to sit back and watch this area closely.

Several property experts are suggesting that the local property market is likely to start moving upwards again once the interest rate rises are over.

Even with prices falling for a couple of months some of our local suburbs enjoyed amazing gains over the 12 months to September 2022

| Bridgeman Downs | $1,200,000 | 40.4% |

| Alderley | $1,280,000 | 32.0% |

| McDowall | $976,500 | 31.5% |

| Wavell Heights | $1,200,000 | 31.1% |

| Everton Park | $903,730 | 30.2% |

At Hicks Real Estate we are excited about the local real estate market in 2023 and are expecting great opportunities for both buyers and sellers. Good quality and well-presented properties will achieve high prices, but there will be bargain opportunities for people looking to enter the market or for an investment property.

Justin Hicks has suggested that selling early in the new year may present the best opportunity for home sellers, so if you would like to discuss how to get the best result for your property reach out to Justin or one of the team.

David Watt is in charge of assisting people to find the right investment property so if you are looking to get your first rental property or build your portfolio then chat with David on 0468 633 493.

House prices are on the move. Find out the value of your property now.

Get a free online property report from Hicks Real Estate. It takes seconds.