On 1 July 2018 new GST-withholding rules took effect requiring buyers of new residential premises and/or potential new land to withhold and pay GST at settlement. The REIQ has updated its contracts to reflect these new rules and this post explains those changes.

The obligations imposed on buyers and sellers under these new rules were incorporated into the REIQ Contract at the end of June 2018, along with other changes to accommodate electronic signing, allow execution of the contract in counterparts, and update references to certain legislation.

Given these significant updates, only new versions of the REIQ Contracts should be used after 1 July 2018, and members should ensure that all parts of the Reference Schedule under the new section titled “GST WITHHOLDING OBLIGATIONS” are properly completed before execution.

Following is an outline and brief explanation of the key changes made to the Reference Schedule under the new part titled “GST WITHHOLDING OBLIGATIONS”:

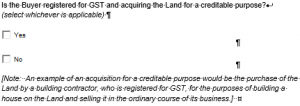

- In the first section, the buyer must make a statement by indicating in the box marked ‘Yes’ or ‘No’ whether they are registered for GST and acquiring the land for a creditable purpose. Under clause 2.5(6) of the Terms of Contract the buyer also warrants that this information is true and correct (see below):

This statement is required to determine whether GST withholding is required, and will be used by the seller to determine whether they are required to give notice in accordance with the new GST withholding rules;

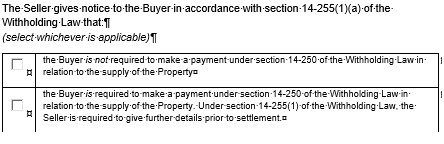

- In the second section, the seller gives notice to the buyer whether or not they are required to withhold GST and pay to the ATO at settlement. If the seller indicates that the buyer is required to withhold and pay GST, the seller will provide further details to the buyer prior to settlement and after the contract is executed (see below):

The requirement to provide notification applies to the sale of all residential premises and potential residential land, subject to certain exceptions;

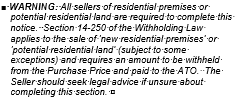

- A warning statement has been included to advise all sellers of residential premises or potential residential land to complete this section (see below):

As stated above, all sellers of residential premises or potential residential land, subject to certain exceptions, are required to notify the buyer whether or not they are required to withhold GST and pay to the ATO at settlement.

Under clause 2.5(5) of the new Terms of Contract, if a seller notifies a buyer in the Reference Schedule that they are required to withhold and pay GST in accordance with the new withholding rules, the seller must provide the buyer with a further notice, and prior to settlement the buyer must then lodge with the ATO certain GST property settlement forms which can be obtained from the ATO.

On or before settlement the buyer is required to provide the seller with a copy of the completed ATO Form 1 together with confirmation from the ATO that all GST property settlement forms have been lodged and a completed ATO payment slip. At settlement the buyer provides the seller with a bank cheque in favour of the Commissioner of Taxation for the withholding amount (taken from the balance of the purchase price payable) which the seller is required to then promptly give to the ATO.

Given the potential financial penalties that may apply for failing to properly comply with these new rules, we strongly recommend that members direct buyers and sellers to obtain advice from a qualified legal professional before executing the contract if they are unsure about their GST withholding obligations.

If you would like more information talk with one of the Hicks Real Estate team, who will be happy to explain it to you.

Source: REIQ blog

House prices are on the rise. Find out the value of your property now.

Get a free online property report from Hicks Real Estate. It takes seconds.